One question I often get asked is ‘How Do I Pay My Tax?’ To answer this, I have done a summary of the major taxes and how to pay them.

1. Corporation Tax

On the anniversary of your year end, you will have received a notification from HMRC to file a Corporation Tax return. This will also give you the information required to make the payment. However, as the tax isn’t then due for another 9 months this notification often gets mislaid!

The easiest way to pay is to make an online bank payment to one of the following accounts:

- Sort code – 08 32 10

- Account number – 12001039

- Account name – HMRC Cumbernauld

- Sort code – 08 32 10

- Account number – 12001020

- Account name – HMRC Shipley

The letter will have said which account to use but if you haven’t got it, then use Cumbernauld.

Make sure you use the correct reference as this will then allocate the payment to your tax account. You will also find the reference on the notification, but your accountant can also give you the correct reference too.

To clarify: Payment is due 9 months and 1 day after your year end and HMRC DO NOT send reminders for this. As a result of late payment, interest will automatically be added.

2. Self Assessment Tax

Self Assessment Tax is due in January and July if you are in the payments on account regime.

HMRC DO send notifications out in January and July for these payments together with details on how to pay.

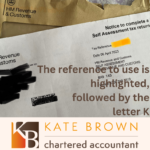

If you do not get a notification, it is still your responsibility to pay the tax. The tax should be made to one of the accounts listed above in the Corporation Tax section (it doesn’t matter which account) and the reference to use is your UTR number followed by the letter K.

3. VAT

VAT is due 7 days following the month after the VAT period, for example, for a VAT return dated 31 March, the VAT is due on 7th May.

The easiest way to pay the VAT is to set up a direct debit. This also gives you a few days grace to pay as they take this around the 10th.

If you choose to pay it instead then the bank details are:

- Sort code – 08 32 00

- Account number – 11963155

- Account name – HMRC VAT

Use your 9 digit VAT number as the reference.

4. PAYE & Class 1a NIC

The easiest way to pay your PAYE & Class 1a NIC is by direct debit. You can set this up in your Government Gateway account and it means that the amounts are taken based on your RTI submissions.

PAYE is due by the 19th of the month that the tax month has ended, for instance 5th November end, is due by the 19th November.

If you prefer to pay directly then the bank account to use is:

- Sort code – 08 32 10

- Account number – 12001039

· Account name – HMRC Cumbernauld

Your reference is the 13 digit Accounts Office Reference number unless you are paying either early or late in which case you need to add an extra 4 digits at the end. These 4 digits can be found in the following table on the HMRC site.

5. Capital Gains Tax

Capital Gains Tax is paid in one of 2 ways depending on what was sold.

Residential Property

If you sold residential property then a separate declaration has to be done. Most importantly the Capital Gains Tax is paid within 60 days of completion of the sale.

Your accountant will be able to advise on this and HMRC will email you with details on how to pay this.

Other Capital Gains

For all other capital gains, these are dealt with through your Self Assessment Return. To clarify, this will be paid with any other Self Assessment tax, as detailed in section 2.

In Conclusion

I hope this has been useful and answered your question, How Do I Pay My Tax?

Please note that HMRC will only ask for payment via postal letter. They do not send emails or text messages to take payment, so if you receive one it is likely to be a scam.

If you have any further questions, please do email me Kate Brown Accountant or your accountant.